This article is for general informational purposes only and is not meant to be used or construed as legal advice in any manner whatsoever. All articles have been scrutinized by a practicing lawyer to ensure accuracy.

So you have or are thinking about giving a loan out to someone. Understandably, you may have doubts, thinking: “how do I know if they can pay back?”

That’s the number one nightmare when you give a loan of any size to friends or family. While you may be prepared to write off small amounts like RM10, the story changes when thousands of Ringgit are involved. What can you do to get your money back then?

Here are some steps you could take to protect yourself when giving a loan to friends and family.

If you’re going to give a friendly loan, the very first thing you should consider for your legal protection is to get a loan agreement (a contract). If that sounds like too much to go through (especially if you need to consult a lawyer), the least you can do for yourself is to get a promissory note (or I.O.U.) written in your favour.

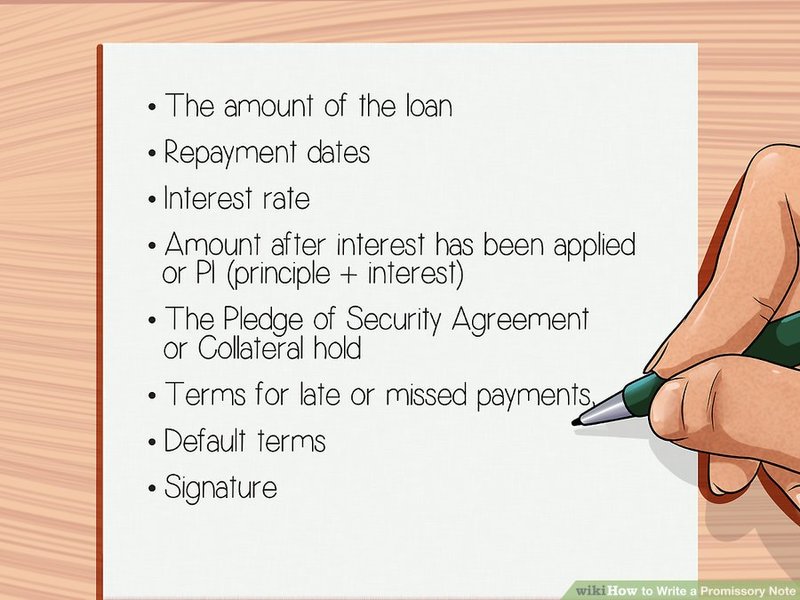

This makes sure that you have documented evidence that the loan exists in the first place. You should include details like how much the loan is for, what are the terms of repayment (lump sum, or by installment, etc.), or what happens if they fail to repay you. Even a simple handwritten note will do it - as long as the necessary details are there it’s enough proof that your loan is real, no need for anything official.

There’s a guide for writing promissory notes on WikiHow you can refer to.

You’ll want to keep any and all evidence that can prove that you passed your friend money. This will be your text messages, email, bank slips, receipts - anything recorded that can prove that money really changed hands between you two. This will help you prove your side of the story in case you have to bring the matter to court.

Make sure you keep this evidence even if you have a contract. Although the contract proves you had an agreement, it doesn’t prove that the money was actually transferred!

Depending on how you see it, a controversial way to encourage timely repayment is to charge interest. According to case law at the time of writing, it’s not outright illegal to charge interest on a friendly loan, although the courts reserve the right to strike out any unfair interest charges for cases that get brought before them. (No, this does not make you an Ah Long as long as you don’t make these loans all the time to make money)

Some people choose to charge interest on the entire loan, and also charge a penalty for late payments. Others only charge interest on late payments. It’s up to you in the end, and this is just an option to consider.

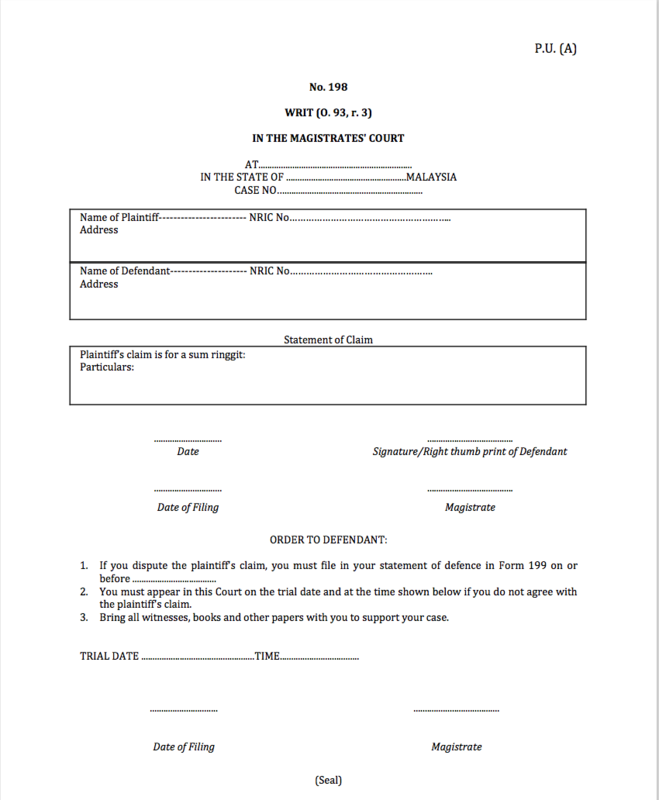

If the amount you loaned out is less than RM5,000. You can file what is known as a small claims procedure to bring your case to court - just fill out a form and pay RM10, no lawyer needed. Keep in mind that for higher sums, you’ll need a lawyer’s help to sue for your money.

Check out our guide on how to make a small claim in the Magistrates Court. For a more detailed run-through of how it works, you’ll want the link below:

This almost goes without saying - you should avoid lending out more than you can afford to lose, even to people you trust with you life. Anything could happen and there are so many reasons why they might end up not being able to repay you (such as accidents and tragedies).

To be prudent, don’t leave your financial security to chance - even if you never get your money back, make sure that you are financially secure, and your lifestyle isn’t affected.