Cars are known as luxury goods since these are expensive and can only be purchased by those who can sustain the expenses accompanying in paying fuel and car maintenance procedures. Due to its high price which almost gets associated with the prices of houses and lots for sale, individuals who are interested in obtaining their own vehicle taps the shoulder of car loan providers.

A car loan application form is a document which is used by loan providers and financial aid companies for their clients whose aim is to borrow a specific value of money for purchasing a car. The common document preparers of this type of application form are not only car loan agencies but also banks and financial institutions as well as car sellers themselves who offer benefits and opportunities to anyone planning to have a car yet does not have sufficient finances to allocate for a car payment.

mbettencourt.weebly.com

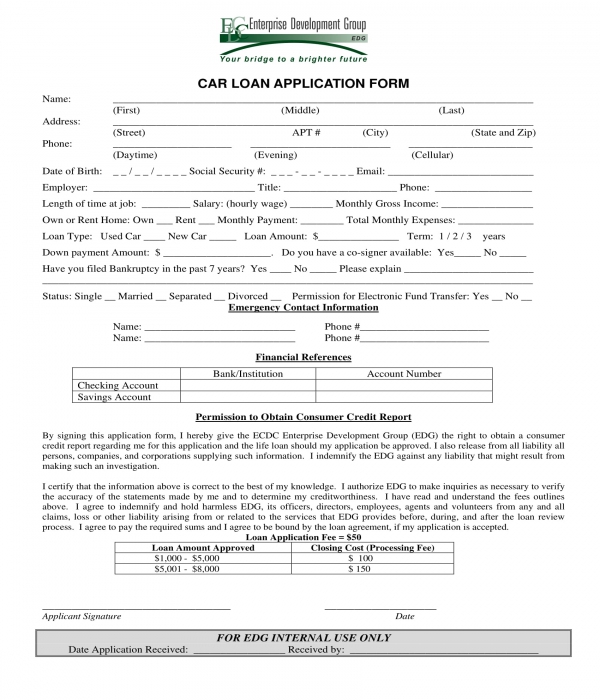

File FormatThe varieties of car loan application forms depend on the type of information that the lender or the loan provider will gather from his clients. Below are some examples of car loan application form varieties that lenders can use:

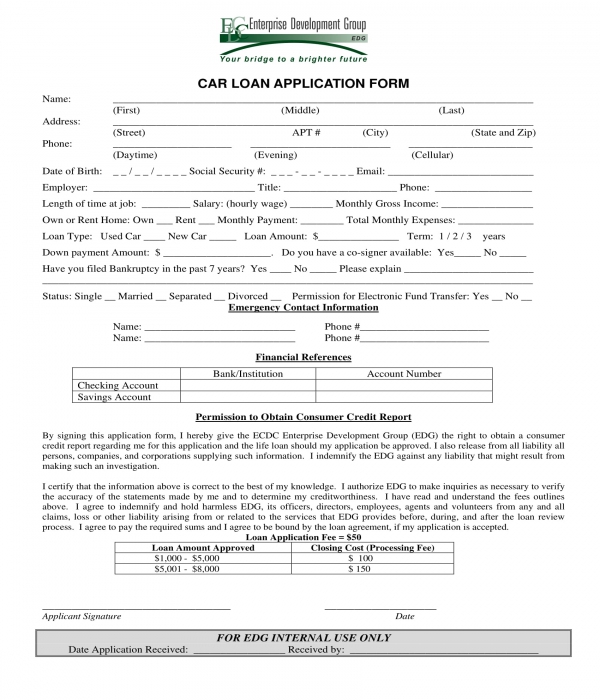

Car Auto Loan Application Form – This variety contains eight sections which should be fulfilled by both the client or the borrower. In the form’s first section, the details of the loan are indicated such as the name of the dealer of the car, the type of car unit the borrower is aiming to purchase with the loaned amount, the unit price of the car, the term, and the amount to be financed by the lender to the client. The second section is intended for the information of the client while the third section will cater his employment information. The fourth section of the form collects the particulars of the client’s co-maker. In addition, the fifth section discloses the credit information of the client to determine his credit score and amount. The succeeding sections of the form are all composed of statements and a list which should be agreed and followed by the client to complete the application. The requirement list is stated in the sixth section of the form while a notification and credit information authorization statement is the contents of the seventh and eight sections of the form.

unionbankph.com

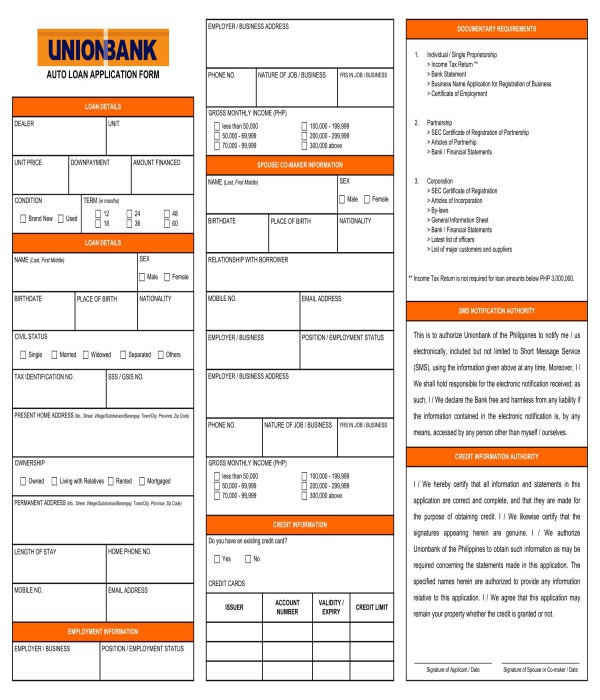

File FormatCar Loan Credit Facility Application Form – Compared to the mentioned variety, this document is intended for obtaining a loan from a company or a business’s credit facility. Along with the essentials of the client and the details of the loan, the form also collects the details of the credit facility wherein the client will be requesting to acquire a sum for his loan. The personal details of the applicant, the car to be purchased, as well as the relationship of the applicant to any of the bank’s or loan provider’s personnel, are all stated in the form. A reference information and a declaration statement are two sections which complete the car loan credit facility application form of the applying client or the loan borrower.

icicibank.lk

File FormatCreating a car loan application form is crucial for any organization who will be supplying the form to their borrowing clients since it is significant to obtain all the essential details of the client for determining whether or not an approval will be granted for the application. To create the form, follow the steps below:

Step 1: Add the organization’s logo and name.

The logo and the name serve as the logo of the document which symbolizes the organization who owns and have provided the document. Along with the logo, an area where the date of when the client is using the form can also be included as well as an area for indicating the document’s file number for easier identification in the organization’s records.

Step 2: Make a client information section.

A client information section should consist of fields which will collect the client’s general information as well as his current financial state. Some of the basic data to be gathered in this section are the client’s full legal name, residential and work address, contact numbers, and the client’s social security number. Moreover, the client’s employment details can also be included such as the client’s employment details ranging from his job schedule and length of being employed under the company that he is disclosing as his employer up to the client’s monthly expenses and household budget amounts.

Step 3: Include a reference section.

The purpose of having a reference section is to ensure that the organization will be able to reach out to people whom the client has been previously or currently associated with for the verification and validation process of the client’s claims and disclosure. In addition to the reference section, the client’s emergency contact person should also be enlisted especially if the client has a certain medical condition which can be a hindrance for him in meeting his responsibilities as a borrower.

Step 4: Incorporate a permission statement.

The permission statement should center on obtaining the credit reports and records of the client from the previous years when he got into a loan. At the bottom of the permission statement should be a signature block where the client will be able to affix his signature to certify that he grants a permission for the organization to gather his credit-related records from his affiliated credit companies.

Step 5: Create a document checklist.

The document checklist can be on a separate sheet depending on what the organization prefers. Nonetheless, it should be able to properly enlist all the required documentation to be submitted by the client for his application. However, this checklist is not intended to be filled out or marked by the client, rather by the portfolio or documentation manager of the organization whose main job description and responsibility are to keep related documents intact as well as up to date for easier reviewing and assessment procedures.

When filling out car loan application forms, applicants or clients should ensure that not a single portion of the form is left blank unless specifically stated in the document itself or instructed by the organization’s representative. Other tips for completing or filling out the form are enlisted below:

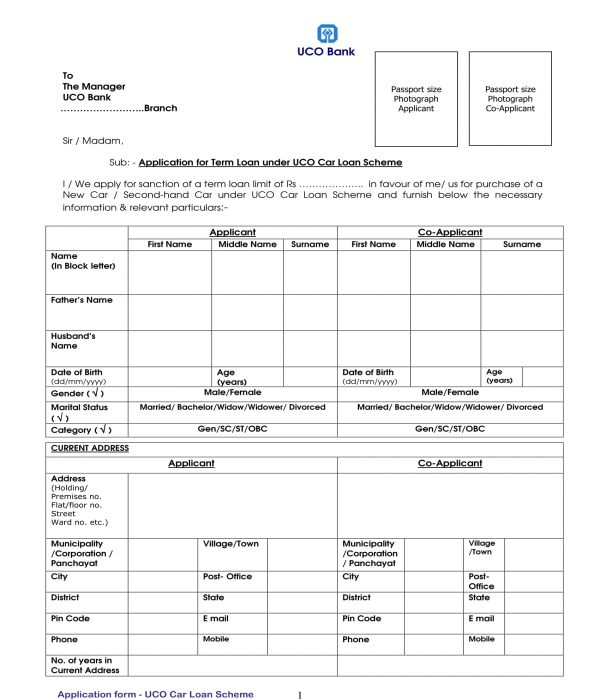

ucobank.com